Introduction

Welcome to the wild world of decentralized finance, where you can learn how do DeFi works, or as the cool kids call it, DeFi. If you’ve ever found yourself scratching your head about what DeFi actually is or how do DeFi works, operates, you’re in the right place. We’re diving deep into the ins and outs of this revolutionary financial ecosystem that’s shaking up the traditional banking world.

Understanding Decentralized Finance (DeFi)

What is DeFi?

Before understanding that how do DeFi works, one should know that what DeFi actually is. DeFi stands for decentralized finance, a movement that leverages blockchain technology to recreate traditional financial systems in a more open, transparent, and accessible manner. Unlike traditional finance, DeFi doesn’t rely on intermediaries like banks or brokers. Instead, it uses smart contracts on blockchain networks to facilitate transactions.

How is DeFi Different from Traditional Finance?

Before understanding that how do DeFi works, you should compare them with traditional finance. In traditional finance, you need banks and financial institutions to manage and execute transactions. They act as middlemen, which often means higher costs, slower processes, and limited access for many people around the world. DeFi eliminates these middlemen, allowing peer-to-peer transactions directly on the blockchain. This means lower fees, faster transaction times, and a more inclusive financial system.

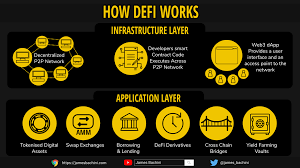

Key Components of DeFi

Blockchain Technology

Before understanding that how do DeFi work, lets have a look on its key components. At the heart of DeFi is blockchain technology. A blockchain is a decentralized ledger that records all transactions across a network of computers. This ensures that every transaction is transparent, secure, and immutable.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute and enforce the contract’s terms when certain conditions are met, eliminating the need for intermediaries.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. In the DeFi ecosystem, cryptocurrencies like Ethereum and stablecoins play a crucial role as they are used to facilitate transactions and smart contracts.

How DeFi Works

Peer-to-Peer Transactions

Before understanding that how do DeFi work, understand the peer-to-peer transaction. One of the core principles of DeFi is peer-to-peer (P2P) transactions. This means that two parties can transact directly without needing a middleman. Blockchain ensures these transactions are secure and transparent.

Lending and Borrowing Platforms

Before understanding that how do DeFi work, understand its major platfoam .DeFi platforms allow users to lend and borrow cryptocurrencies without the need for a traditional bank. Lenders can earn interest on their assets, while borrowers can obtain loans instantly by providing collateral.

Decentralized Exchanges (DEXs)

Before understanding that how do DeFi work, lets know the decentralized exchanges (DEXs) enable users to trade cryptocurrencies directly with one another. Unlike centralized exchanges, DEXs don’t hold users’ funds, reducing the risk of hacks and offering more privacy.

Yield Farming and Staking

Before understanding that how do DeFi work, lets know, Yield farming involves lending or staking your crypto assets to earn rewards. Staking, on the other hand, involves participating in the proof-of-stake (PoS) process to help secure the network and earn staking rewards.

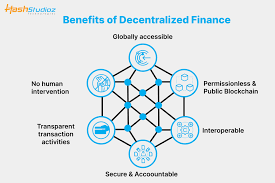

Advantages of DeFi

Accessibility

Before understanding that how do DeFi work, lets know some of its advantages. DeFi opens up financial services to anyone with an internet connection. This is a game-changer for people in regions with limited access to traditional banking services.

Transparency

All transactions on DeFi platforms are recorded on the blockchain, making them transparent and easily verifiable. This reduces the risk of fraud and enhances trust.

Lower Costs

By eliminating intermediaries, DeFi significantly reduces transaction costs. Users can save on fees that would typically go to banks or other financial institutions.

Challenges and Risks in DeFi

Security Risks

While DeFi offers numerous benefits, it’s not without risks. Smart contracts, while secure, can have vulnerabilities that hackers can exploit. There have been several high-profile hacks in the DeFi space.

Regulatory Concerns

The regulatory environment for DeFi is still evolving. Governments around the world are grappling with how to regulate this new financial ecosystem. Regulatory changes can impact the growth and adoption of DeFi.

Market Volatility

Cryptocurrencies are known for their volatility. This can pose a risk for DeFi users, especially those involved in lending, borrowing, or yield farming.

The Future of DeFi

The future of DeFi is bright but uncertain. Innovations continue to emerge, making the ecosystem more robust and user-friendly. However, the industry must navigate regulatory challenges and security issues to achieve mainstream adoption.

Conclusion

Decentralized finance is revolutionizing the way we think about and interact with financial systems. By leveraging blockchain technology and smart contracts, DeFi offers a more open, transparent, and accessible financial system. But before knowing that how do DeFi works,it’s essential to be aware of the risks and challenges that come with this new frontier.

Here are some FAQs on the topic of how decentralized finance (DeFi) works:

Q: What is DeFi?

A: DeFi (Decentralized Finance) is a financial system that uses blockchain technology and cryptocurrencies to provide decentralized financial services, such as lending, borrowing, and trading.

Q: How does DeFi differ from traditional finance?

A: DeFi operates without central intermediaries like banks, governments, or institutions, allowing for peer-to-peer transactions and greater control over one’s assets.

Q: What are the key components of DeFi?

A: The key components of DeFi include:

1. Decentralized exchanges (DEXs): Enable trustless and permissionless trading.

2. Lending protocols: Facilitate decentralized lending and borrowing.

3. Stablecoins: Pegged to the value of a traditional currency, reducing volatility.

4. Smart contracts: Self-executing contracts with the terms of the agreement written directly into code.

Q: How do DeFi loans work?

A: DeFi loans are collateralized loans, where borrowers provide cryptocurrency as collateral to receive a loan in another cryptocurrency or stablecoin.

Q: What are the benefits of DeFi?

A: The benefits of DeFi include:

1. Decentralization: No central authority controlling your assets.

2. Transparency: All transactions are recorded on the blockchain.

3. Accessibility: Anyone with an internet connection can participate.

4. Efficiency: Automated processes reduce the need for intermediaries.

Q: What are the risks associated with DeFi?

A: The risks associated with DeFi include:

1. Market volatility: Cryptocurrency prices can fluctuate rapidly.

2. Smart contract risks: Bugs or security vulnerabilities in smart contracts.

3. Liquidity risks: Illiquidity can lead to large price slippages.

4. Regulatory risks: Evolving regulatory landscape may impact DeFi.

Let me know if you’d like me to add more FAQs!